The Buzz on Private Wealth Management Canada

Table of ContentsThe 4-Minute Rule for Investment RepresentativeSome Known Details About Private Wealth Management Canada See This Report on Investment ConsultantIndependent Financial Advisor Canada Fundamentals ExplainedSome Known Details About Ia Wealth Management How Retirement Planning Canada can Save You Time, Stress, and Money.

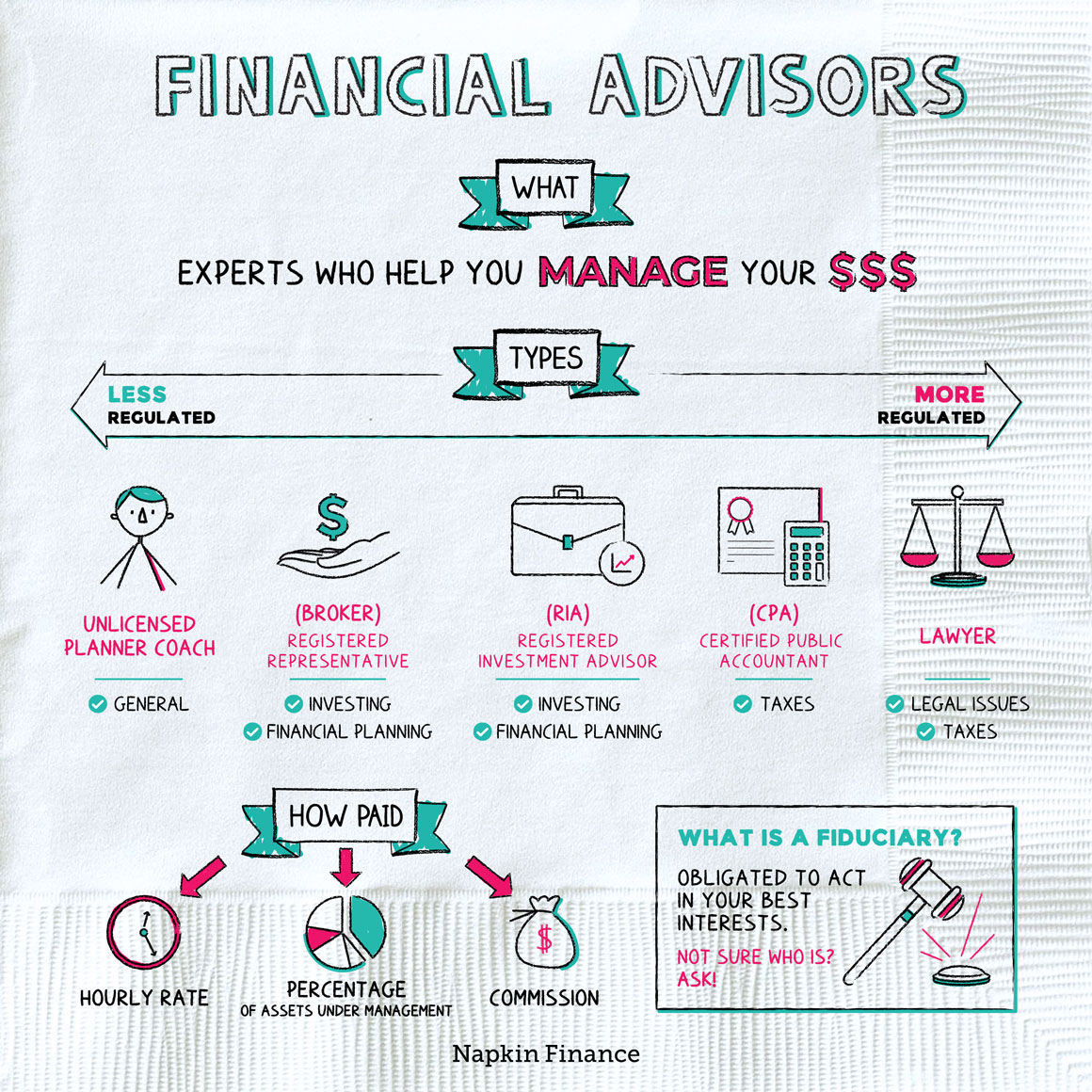

Heath can be an advice-only coordinator, consequently the guy doesn’t manage his customers’ money right, nor does the guy promote them specific financial products. Heath claims the appeal of this approach to him would be that the guy doesn’t feel sure to provide some product to fix a client’s cash issues. If an advisor is geared up to offer an insurance-based treatment for a problem, they might find yourself steering somebody down an unproductive path within the title of striking revenue quotas, he states.“Most financial solutions folks in Canada, because they’re paid according to the items they provide and sell, they may be able have reasons to advise one plan of action over another,” he says.“I’ve chosen this program of motion because i will seem my clients to them and never feel like I’m taking advantage of all of them in any way or attempting to make a sales pitch.” Tale continues below ad FCAC notes the way you pay your advisor relies on this service membership they provide.

The Basic Principles Of Private Wealth Management Canada

Heath with his ilk are settled on a fee-only design, which means that they’re paid like a lawyer may be on a session-by-session foundation or a per hour assessment rate (retirement planning canada). With respect to the selection of services while the expertise or typical customer base of the expert or coordinator, hourly charges ranges when you look at the 100s or thousands, Heath claims

This is up to $250,000 and above, he states, which boxes aside the majority of Canadian families from this level of solution. Tale continues below advertising for people unable to pay charges for advice-based approaches, as well as those hesitant to give up some regarding investment returns or without enough cash to get started with an advisor, there are several cheaper and also complimentary alternatives to take into consideration.

Getting The Retirement Planning Canada To Work

Tale goes on below ad discovering the right financial planner is a little like dating, Heath claims: You need to discover some one who’s reputable, features a character fit and is also just the right person for all the phase Read Full Report of existence you’re in (https://www.wattpad.com/user/lighthousewm). Some choose their own experts getting older with a bit more knowledge, he says, while others like somebody more youthful who is going to hopefully stay with them from early years through your retirement

The Definitive Guide for Retirement Planning Canada

One of the primary errors some body make in selecting an advisor just isn't inquiring adequate concerns, Heath says. He’s amazed as he hears from customers that they’re stressed about inquiring questions and probably appearing foolish a trend the guy locates is as common with established experts and older adults.“I’m surprised, given that it’s their cash and they’re spending lots of costs to these individuals,” according to him.“You need having the questions you have answered therefore deserve having an unbarred and sincere commitment.” 6:11 Financial planning all Heath’s last information applies whether you’re looking external monetary support or you’re going it alone: educate yourself.

Here are four things to consider and ask your self when learning whether you really need to touch the expertise of a financial expert. Your web well worth is certainly not your revenue, but instead a quantity which will help you recognize just what cash you earn, simply how much you save, and where you spend some money, too.

Some Ideas on Independent Investment Advisor Canada You Need To Know

Your infant is found on the way in which. Your splitting up is pending. You’re approaching your retirement. These as well as other major existence occasions may prompt the need to visit with a financial consultant regarding your investments, your financial objectives, as well as other monetary issues. Let’s say the mommy left you a tidy sum of money in her own will.

You have sketched out your own economic strategy, but I have a hard time staying with it. A financial advisor may offer the responsibility that you need to put your monetary intend on track. In addition they may recommend ideas on how to tweak your monetary program - https://papaly.com/categories/share?id=5ae85fbc345f4fe897f82c8be2177d5f to optimize the potential results

What Does Independent Investment Advisor Canada Do?

Anyone can say they’re a monetary expert, but an advisor with expert designations is preferably the one you really need to hire. In 2021, around 330,300 Us americans worked as personal financial advisors, according to research by the U.S. Bureau of work studies (BLS). Many financial experts are self-employed, the bureau claims - investment representative. Generally, there are five forms of monetary analysts

Brokers usually make earnings on deals they make. Agents are regulated of the U.S. Securities and Exchange Commission (SEC), the economic business Regulatory Authority (FINRA) and state securities regulators. A registered investment advisor, either someone or a firm, is similar to a registered consultant. Both buy and sell financial investments with respect to their clients.